年金终值系数

出自 MBA智库百科(https://wiki.mbalib.com/)

目录 |

年金终值系数指固定的间隔时间相等的期间(如以年为单位)分期支付(存入)1元金额,经过若干年后按复利计算的累计本利之和。

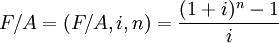

年金终值系数公式如下:

年金终值系数(Future value of an annuity factor)=F/A=(F/A,i,n)

这里F/A=(F/A,i,n)代表年金终值系数,i代表利率,n代表年数。

该公式可由复利公式推导出来,推导过程如下:

第1年存入1元到第n年的本利和 = (1 + i)n − 1

第2年存入1元到第n年的本利和 = (1 + i)n − 2

......

第(n-1)年存入1元到第n年的本利和=(1+i)

第n年存入l元 = (1 + i)0

因此,各年本利和相加得:

An | i = (1 + i)n − 1 + (1 + i)n − 2...... + (1 + i) + 1 (1)

两边乘以(1+i),则

(1 + i)An | i = (1 + i)n + (1 + i)n − 1 + ...... + (1 + i) (2)

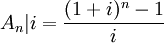

(2)-(1)得iAn | i = (1 + i)n − 1,即

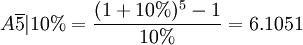

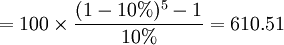

例:按年利率10%计算5年的年金终值系数如下:

为了方便年金终值系数的运用,对不同年数不同利率分别计算出年金终值系数,列示成年金终值系数表。亦称“1元普通年金终值表”。运用年金终值系数求等额支付若干年后的年金终值就很方便。

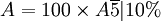

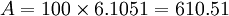

例:每年存入银行100元,按年利率l0%复利计算,第5年后的本利和(用A表示)为多少?计算如 下:

(1)用公式计算

元

元

(2)查表计算

元

元

| 期数 | 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% | 12% | 13% | 14% | 15% | 16% | 17% | 18% | 19% | 20% | 21% | 22% | 23% | 24% | 25% | 26% | 27% | 28% | 29% | 30% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| 2 | 2.0100 | 2.0200 | 2.0300 | 2.0400 | 2.0500 | 2.0600 | 2.0700 | 2.0800 | 2.0900 | 2.1000 | 2.1100 | 2.1200 | 2.1300 | 2.1400 | 2.1500 | 2.1600 | 2.1700 | 2.1800 | 2.1900 | 2.2000 | 2.2100 | 2.2200 | 2.2300 | 2.2400 | 2.2500 | 2.2600 | 2.2700 | 2.2800 | 2.2900 | 2.3000 |

| 3 | 3.0301 | 3.0604 | 3.0909 | 3.1216 | 3.1525 | 3.1836 | 3.2149 | 3.2464 | 3.2781 | 3.3100 | 3.3421 | 3.3744 | 3.4069 | 3.4396 | 3.4725 | 3.5056 | 3.5389 | 3.5724 | 3.6061 | 3.6400 | 3.6741 | 3.7084 | 3.7429 | 3.7776 | 3.8125 | 3.8476 | 3.8829 | 3.9184 | 3.9541 | 3.9900 |

| 4 | 4.0604 | 4.1216 | 4.1836 | 4.2465 | 4.3101 | 4.3746 | 4.4399 | 4.5061 | 4.5731 | 4.6410 | 4.7097 | 4.7793 | 4.8498 | 4.9211 | 4.9934 | 5.0665 | 5.1405 | 5.2154 | 5.2913 | 5.3680 | 5.4457 | 5.5242 | 5.6038 | 5.6842 | 5.7656 | 5.8480 | 5.9313 | 6.0156 | 6.1008 | 6.1870 |

| 5 | 5.1010 | 5.2040 | 5.3091 | 5.4163 | 5.5256 | 5.6371 | 5.7507 | 5.8666 | 5.9847 | 6.1051 | 6.2278 | 6.3528 | 6.4803 | 6.6101 | 6.7424 | 6.8771 | 7.0144 | 7.1542 | 7.2966 | 7.4416 | 7.5892 | 7.7396 | 7.8926 | 8.0484 | 8.2070 | 8.3684 | 8.5327 | 8.6999 | 8.8700 | 9.0431 |

| 6 | 6.1520 | 6.3081 | 6.4684 | 6.6330 | 6.8019 | 6.9753 | 7.1533 | 7.3359 | 7.5233 | 7.7156 | 7.9129 | 8.1152 | 8.3227 | 8.5355 | 8.7537 | 8.9775 | 9.2068 | 9.4420 | 9.6830 | 9.9299 | 10.1830 | 10.4423 | 10.7079 | 10.9801 | 11.2588 | 11.5442 | 11.8366 | 12.1359 | 12.4423 | 12.7560 |

| 7 | 7.2135 | 7.4343 | 7.6625 | 7.8983 | 8.1420 | 8.3938 | 8.6540 | 8.9228 | 9.2004 | 9.4872 | 9.7833 | 10.0890 | 10.4047 | 10.7305 | 11.0668 | 11.4139 | 11.7720 | 12.1415 | 12.5227 | 12.9159 | 13.3214 | 13.7396 | 14.1708 | 14.6153 | 15.0735 | 15.5458 | 16.0324 | 16.5339 | 17.0506 | 17.5828 |

| 8 | 8.2857 | 8.5830 | 8.8923 | 9.2142 | 9.5491 | 9.8975 | 10.2598 | 10.6366 | 11.0285 | 11.4359 | 11.8594 | 12.2997 | 12.7573 | 13.2328 | 13.7268 | 14.2401 | 14.7733 | 15.3270 | 15.9020 | 16.4991 | 17.1189 | 17.7623 | 18.4300 | 19.1229 | 19.8419 | 20.5876 | 21.3612 | 22.1634 | 22.9953 | 23.8577 |

| 9 | 9.3685 | 9.7546 | 10.1591 | 10.5828 | 11.0266 | 11.4913 | 11.9780 | 12.4876 | 13.0210 | 13.5795 | 14.1640 | 14.7757 | 15.4157 | 16.0853 | 16.7858 | 17.5185 | 18.2847 | 19.0859 | 19.9234 | 20.7989 | 21.7139 | 22.6700 | 23.6690 | 24.7125 | 25.8023 | 26.9404 | 28.1287 | 29.3692 | 30.6639 | 32.0150 |

| 10 | 10.4622 | 10.9497 | 11.4639 | 12.0061 | 12.5779 | 13.1808 | 13.8164 | 14.4866 | 15.1929 | 15.9374 | 16.7220 | 17.5487 | 18.4197 | 19.3373 | 20.3037 | 21.3215 | 22.3931 | 23.5213 | 24.7089 | 25.9587 | 27.2738 | 28.6574 | 30.1128 | 31.6434 | 33.2529 | 34.9449 | 36.7235 | 38.5926 | 40.5564 | 42.6195 |

| 11 | 11.5668 | 12.1687 | 12.8078 | 13.4864 | 14.2068 | 14.9716 | 15.7836 | 16.6455 | 17.5603 | 18.5312 | 19.5614 | 20.6546 | 21.8143 | 23.0445 | 24.3493 | 25.7329 | 27.1999 | 28.7551 | 30.4035 | 32.1504 | 34.0013 | 35.9620 | 38.0388 | 40.2379 | 42.5661 | 45.0306 | 47.6388 | 50.3985 | 53.3178 | 56.4053 |

| 12 | 12.6825 | 13.4121 | 14.1920 | 15.0258 | 15.9171 | 16.8699 | 17.8885 | 18.9771 | 20.1407 | 21.3843 | 22.7132 | 24.1331 | 25.6502 | 27.2707 | 29.0017 | 30.8502 | 32.8239 | 34.9311 | 37.1802 | 39.5805 | 42.1416 | 44.8737 | 47.7877 | 50.8950 | 54.2077 | 57.7386 | 61.5013 | 65.5100 | 69.7800 | 74.3270 |

| 13 | 13.8093 | 14.6803 | 15.6178 | 16.6268 | 17.7130 | 18.8821 | 20.1406 | 21.4953 | 22.9534 | 24.5227 | 26.2116 | 28.0291 | 29.9847 | 32.0887 | 34.3519 | 36.7862 | 39.4040 | 42.2187 | 45.2445 | 48.4966 | 51.9913 | 55.7459 | 59.7788 | 64.1097 | 68.7596 | 73.7506 | 79.1066 | 84.8529 | 91.0161 | 97.6250 |

| 14 | 14.9474 | 15.9739 | 17.0863 | 18.2919 | 19.5986 | 21.0151 | 22.5505 | 24.2149 | 26.0192 | 27.9750 | 30.0949 | 32.3926 | 34.8827 | 37.5811 | 40.5047 | 43.6720 | 47.1027 | 50.8180 | 54.8409 | 59.1959 | 63.9095 | 69.0100 | 74.5280 | 80.4961 | 86.9495 | 93.9258 | 101.4654 | 109.6117 | 118.4108 | 127.9125 |

| 15 | 16.0969 | 17.2934 | 18.5989 | 20.0236 | 21.5786 | 23.2760 | 25.1290 | 27.1521 | 29.3609 | 31.7725 | 34.4054 | 37.2797 | 40.4175 | 43.8424 | 47.5804 | 51.6595 | 56.1101 | 60.9653 | 66.2607 | 72.0351 | 78.3305 | 85.1922 | 92.6694 | 100.8151 | 109.6868 | 119.3465 | 129.8611 | 141.3029 | 153.7500 | 167.2863 |

| 16 | 17.2579 | 18.6393 | 20.1569 | 21.8245 | 23.6575 | 25.6725 | 27.8881 | 30.3243 | 33.0034 | 35.9497 | 39.1899 | 42.7533 | 46.6717 | 50.9804 | 55.7175 | 60.9250 | 66.6488 | 72.9390 | 79.8502 | 87.4421 | 95.7799 | 104.9345 | 114.9834 | 126.0108 | 138.1085 | 151.3766 | 165.9236 | 181.8677 | 199.3374 | 218.4722 |

| 17 | 18.4304 | 20.0121 | 21.7616 | 23.6975 | 25.8404 | 28.2129 | 30.8402 | 33.7502 | 36.9737 | 40.5447 | 44.5008 | 48.8837 | 53.7391 | 59.1176 | 65.0751 | 71.6730 | 78.9792 | 87.0680 | 96.0218 | 105.9306 | 116.8937 | 129.0201 | 142.4295 | 157.2534 | 173.6357 | 191.7345 | 211.7230 | 233.7907 | 258.1453 | 285.0139 |

| 18 | 19.6147 | 21.4123 | 23.4144 | 25.6454 | 28.1324 | 30.9057 | 33.9990 | 37.4502 | 41.3013 | 45.5992 | 50.3959 | 55.7497 | 61.7251 | 68.3941 | 75.8364 | 84.1407 | 93.4056 | 103.7403 | 115.2659 | 128.1167 | 142.4413 | 158.4045 | 176.1883 | 195.9942 | 218.0446 | 242.5855 | 269.8882 | 300.2521 | 334.0074 | 371.5180 |

| 19 | 20.8109 | 22.8406 | 25.1169 | 27.6712 | 30.5390 | 33.7600 | 37.3790 | 41.4463 | 46.0185 | 51.1591 | 56.9395 | 63.4397 | 70.7494 | 78.9692 | 88.2118 | 98.6032 | 110.2846 | 123.4135 | 138.1664 | 154.7400 | 173.3540 | 194.2535 | 217.7116 | 244.0328 | 273.5558 | 306.6577 | 343.7580 | 385.3227 | 431.8696 | 483.9734 |

| 20 | 22.0190 | 24.2974 | 26.8704 | 29.7781 | 33.0660 | 36.7856 | 40.9955 | 45.7620 | 51.1601 | 57.2750 | 64.2028 | 72.0524 | 80.9468 | 91.0249 | 102.4436 | 115.3797 | 130.0329 | 146.6280 | 165.4180 | 186.6880 | 210.7584 | 237.9893 | 268.7853 | 303.6006 | 342.9447 | 387.3887 | 437.5726 | 494.2131 | 558.1118 | 630.1655 |

| 21 | 23.2392 | 25.7833 | 28.6765 | 31.9692 | 35.7193 | 39.9927 | 44.8652 | 50.4229 | 56.7645 | 64.0025 | 72.2651 | 81.6987 | 92.4699 | 104.7684 | 118.8101 | 134.8405 | 153.1385 | 174.0210 | 197.8474 | 225.0256 | 256.0176 | 291.3469 | 331.6059 | 377.4648 | 429.6809 | 489.1098 | 556.7173 | 633.5927 | 720.9642 | 820.2151 |

| 22 | 24.4716 | 27.2990 | 30.5368 | 34.2480 | 38.5052 | 43.3923 | 49.0057 | 55.4568 | 62.8733 | 71.4027 | 81.2143 | 92.5026 | 105.4910 | 120.4360 | 137.6316 | 157.4150 | 180.1721 | 206.3448 | 236.4385 | 271.0307 | 310.7813 | 356.4432 | 408.8753 | 469.0563 | 538.1011 | 617.2783 | 708.0309 | 811.9987 | 931.0438 | 1067.2796 |

| 23 | 25.7163 | 28.8450 | 32.4529 | 36.6179 | 41.4305 | 46.9958 | 53.4361 | 60.8933 | 69.5319 | 79.5430 | 91.1479 | 104.6029 | 120.2048 | 138.2970 | 159.2764 | 183.6014 | 211.8013 | 244.4868 | 282.3618 | 326.2369 | 377.0454 | 435.8607 | 503.9166 | 582.6298 | 673.6264 | 778.7707 | 900.1993 | 1040.3583 | 1202.0465 | 1388.4635 |

| 24 | 26.9735 | 30.4219 | 34.4265 | 39.0826 | 44.5020 | 50.8156 | 58.1767 | 66.7648 | 76.7898 | 88.4973 | 102.1742 | 118.1552 | 136.8315 | 158.6586 | 184.1678 | 213.9776 | 248.8076 | 289.4945 | 337.0105 | 392.4842 | 457.2249 | 532.7501 | 620.8174 | 723.4610 | 843.0329 | 982.2511 | 1144.2531 | 1332.6586 | 1551.6400 | 1806.0026 |

| 25 | 28.2432 | 32.0303 | 36.4593 | 41.6459 | 47.7271 | 54.8645 | 63.2490 | 73.1059 | 84.7009 | 98.3471 | 114.4133 | 133.3339 | 155.6196 | 181.8708 | 212.7930 | 249.2140 | 292.1049 | 342.6035 | 402.0425 | 471.9811 | 554.2422 | 650.9551 | 764.6054 | 898.0916 | 1054.7912 | 1238.6363 | 1454.2014 | 1706.8031 | 2002.6156 | 2348.8033 |

| 26 | 29.5256 | 33.6709 | 38.5530 | 44.3117 | 51.1135 | 59.1564 | 68.6765 | 79.9544 | 93.3240 | 109.1818 | 127.9988 | 150.3339 | 176.8501 | 208.3327 | 245.7120 | 290.0883 | 342.7627 | 405.2721 | 479.4306 | 567.3773 | 671.6330 | 795.1653 | 941.4647 | 1114.6336 | 1319.4890 | 1561.6818 | 1847.8358 | 2185.7079 | 2584.3741 | 3054.4443 |

| 27 | 30.8209 | 35.3443 | 40.7096 | 47.0842 | 54.6691 | 63.7058 | 74.4838 | 87.3508 | 102.7231 | 121.0999 | 143.0786 | 169.3740 | 200.8406 | 238.4993 | 283.5688 | 337.5024 | 402.0323 | 479.2211 | 571.5224 | 681.8528 | 813.6759 | 971.1016 | 1159.0016 | 1383.1457 | 1650.3612 | 1968.7191 | 2347.7515 | 2798.7061 | 3334.8426 | 3971.7776 |

| 28 | 32.1291 | 37.0512 | 42.9309 | 49.9676 | 58.4026 | 68.5281 | 80.6977 | 95.3388 | 112.9682 | 134.2099 | 159.8173 | 190.6989 | 227.9499 | 272.8892 | 327.1041 | 392.5028 | 471.3778 | 566.4809 | 681.1116 | 819.2233 | 985.5479 | 1185.7440 | 1426.5719 | 1716.1007 | 2063.9515 | 2481.5860 | 2982.6444 | 3583.3438 | 4302.9470 | 5164.3109 |

| 29 | 33.4504 | 38.7922 | 45.2189 | 52.9663 | 62.3227 | 73.6398 | 87.3465 | 103.9659 | 124.1354 | 148.6309 | 178.3972 | 214.5828 | 258.5834 | 312.0937 | 377.1697 | 456.3032 | 552.5121 | 669.4475 | 811.5228 | 984.0680 | 1193.5129 | 1447.6077 | 1755.6835 | 2128.9648 | 2580.9394 | 3127.7984 | 3788.9583 | 4587.6801 | 5551.8016 | 6714.6042 |

| 30 | 34.7849 | 40.5681 | 47.5754 | 56.0849 | 66.4388 | 79.0582 | 94.4608 | 113.2832 | 136.3075 | 164.4940 | 199.0209 | 241.3327 | 293.1992 | 356.7868 | 434.7451 | 530.3117 | 647.4391 | 790.9480 | 966.7122 | 1181.8816 | 1445.1507 | 1767.0813 | 2160.4907 | 2640.9164 | 3227.1743 | 3942.0260 | 4812.9771 | 5873.2306 | 7162.8241 | 8729.9855 |

谢谢