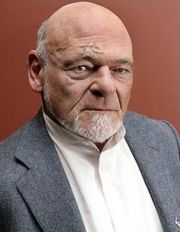

山姆·澤爾

出自 MBA智库百科(https://wiki.mbalib.com/)

目錄 |

山姆·澤爾是芝加哥房地產巨亨,被譽為房產界的“山姆大叔。擁有50億美元資本凈值的澤爾,在2008年《福布斯》“美國富豪400強”排行榜上名列第68位。[1][2]

澤爾是股本集團投資(Equity Group Investments)的主席,該集團是私人股本和公開發行公司的混合體,包括了住宅地產(Equity Residential),一家業內領先的住宅公司;生活時尚置業(Equity LifeStyle Properties),一家由300個度假和工廠預製住房協會的公司;資產信托公司(Capital Trust),一家商業房地產金融公司。

澤爾愛抽煙,愛騎自行車,愛穿開領襯衫。早在上學期間,他就頗有投機意識,曾經購買了一批《花花公子》雜誌,然後高價轉手賣給小伙伴們。上世紀 60年代中期,正在讀大學,之後成為密歇根大學法學院學生的澤爾已開始在安娜堡(Ann Arbor)購入房產。之後他與同父異母的兄弟羅伯特·勞瑞合伙,直至1990年勞瑞48歲時死於癌症,兩人共同建立起了一個地產王國。

Samuel "Sam" Zell (born September 1941) is a U.S.-born billionaire and real estate entrepreneur. He is co-founder and Chairperson|Chairman of Equity Group Investments, a private investment firm. With an estimated net worth of US$5 billion, he is ranked as the 68th richest American by Forbes[2]In April 2007, Zell completed a leveraged buyout of the Tribune Company, publisher of the Chicago Tribune and the Los Angeles Times. He is also the owner of the Chicago Cubs.

Zell was born in Chicago in 1941 to Jewish immigrant parents from Poland who fled the country just before the Nazi invasion in 1939. Shortly after moving from Seattle to Chicago, Zell's father Bernard changed the family name from Zielonka to Zell.[3] He received his Bachelor of Arts (1963) from the University of Michigan, where he was a member of the Alpha Epsilon Pi fraternity. He also received his Juris Doctor|JD (1966) from the University of Michigan Law School.[4]

Zell, with Robert Lurie went on to found the Equity Group Investments, LLC, which spawned three real estate public companies, including: Equity Residential, the largest apartment owner in the United States; Equity Office Properties, the largest office owner in the country; and Manufactured Home Communities, a mobile home company. In addition, Zell has created a number of public and private companies. He also controls SZ Investments LLC as his investment arm.

Zell is also Chairman of Capital Trust Inc., a finance and investment management company focused on the commercial real estate industry, and Anixter International, the world's largest distributor of communication products and electrical and electronic wire and cable.

Recently, the Blackstone Group completed its purchase of Zell's Equity Office Properties Trust for $39 billion,[5] and sold off many of the portfolio's properties for record amounts.[6]

Between 1992 and 1999, Zell's Chillmark fund owned Jacor Communications, Inc., a successful radio broadcast group that included a television station. The company was sold to Clear Channel Communications in 1999.

On April 2, 2007, the Tribune Company announced their acceptance of Zell's offer to buy the Chicago Tribune, the Los Angeles Times, and other media assets. On December 20, 2007, Zell took the company private, and the following day he became the Chairman and CEO. He plans to sell the Chicago Cubs, and sell the company's 25 percent interest in Comcast SportsNet Chicago.

In a sharply critical June 2008 opinion piece for the Washington Post entitled, "The L.A. Times' Human Wrecking Ball", veteran Los Angeles-based editor and columnist Harold Meyerson took Zell to task for "taking bean counting to a whole new level", asserting that "he's well on his way to... destroying the L.A. Times." Comparing Zell to James McNamara, who was sentenced to life in prison for the notorious 1910 Los Angeles Times bombing (which killed 21 employees), Meyerson concluded his article by opining that "Life in San Quentin sounds about right" for Zell.[7]

Zell is known for using "salty" language in the newsroom.[8] In February 2008, the website LA Observed reprinted an internal memo that said:

"Last week you may have encountered some colorful uses of the lexicon from Sam Zell that we are not used to hearing at the Times... But of course we still have the same expectations at the Times of what is correct in the workplace. It's not good judgment to use profane or hostile language and we can't tolerate that... In short, nothing changes; the fundamental rules of decorum and decency apply... Sam is a force of a nature; the rest of us are bound by the normal conventions of society."[9]

A long-time supporter of the Wharton School of the University of Pennsylvania, he helped fund the Real Estate Department at Wharton, as well as the Zell-Lurie Institute at the Ross School of Business at University of Michigan. Zell also endowed the Zell Center for Risk Research at the Kellogg School of Management at Northwestern University, and the Samuel Zell and Robert Lurie Real Estate Center at the Wharton School. Zell has also donated significantly to his alma mater, the University of Michigan.

Zell, according to The Forward[10], is also "a major donor to causes in the Middle East. His donations include a $3.1 million donation to the Herzliya Interdisciplinary Center in Israel and separate donations to the Israel Center for Social and Economic Progress, a free market oriented Israeli think tank founded by Daniel Doron. In the United States, he has given major gifts to such Jewish causes as the American Jewish Committee and a Chicago Jewish day school named after his father."

Zell has donated to both United States Republican Party and United States Democratic Party candidates — with more money going to the former — as well as to lobbying groups representing the real estate industry. According to an analysis of Federal Election Commission records by the Center for Public Integrity, "Zell has given more than $100,000 in political contributions since the 1998 election cycle, most of it supporting Republican causes."[11]

Zell was recently implicated in the complaint against Illinois Governor Rod Blagojevich. According to the Associated Press, Zell "got the message and is very sensitive to the issue." The issue in question was the firing of certain editorial staff members in exchange for tax breaks on the sale of Wrigley Field.[12] Zell has yet to state that he would not have fired the editor mentioned in the federal complaint in exchange for the tax break in question.

In 2008, Zell announced a plan to place the Chicago Cubs and Wrigley Field up for sale separately in order to maximize profits. He also announced he would consider selling naming rights to Wrigley Field for anyone willing to put up the money. These announcements have been widely unpopular in Chicago[13][14] and a poll taken by the Chicago Sun-Times showed that 53% of 2,000 people who voted said they would no longer attend Cubs games if the field was renamed.[15]

In April 2008, Zell made a controversial comment about the subprime mortgage crisis at a conference in Los Angeles, where he stated, "this country needs a cleansing. We need to clean out all those people who never should have been in houses in the first place."

In June 2008, Politicker.com editorial cartoonist Rob Tornoe took Sam Zell to task for the changes he has brought to both the Los Angeles Times and the Tribune Company. But since Zell has taken over Tribune and the media industry has experienced an unprecedented decline, no one else has put an idea on the table to reinvent a sustainable newspaper product.[16]

山姆·澤爾(Sam Zell)是一位將資產建立在業界周期之上的地產投資大師,他最近指出,金融市場的現時動蕩實則是市場對新一輪經濟過剩的感性回應,而非真正的信貸危機。

在沃頓商學院的一次由地產學教授彼得·利曼(Peter Linneman)主持,涉及廣泛的講座中,這位公司總部位於芝加哥的地產投資人談到,現在的市場正受美國次級信貸市場的問題所困擾,但是,人們仍有足夠的資金周轉,這與其它地產蕭條時期現金流極度緊縮的情況大有不同。

“我們並非真正處於大家所說的‘信貸危機’之中,我認為大家陷入的是一場‘信心危機’”澤爾說道,他是沃頓商學院塞繆爾和羅伯特勞瑞房地產研究中心的贊助者。“我的觀點是,兩個月前存在的流動性過剩問題,現在仍然存在。雖然風險溢價不同了,但實際的流動性量仍未改變。”

澤爾還提到,經濟的滑坡應在預料之中:“過去的三年裡,人們表現得過分輕率。他們想要什麼便買什麼,並且毫不考慮自己的購買能力並以此為榮。我想這些人現在都該懊喪無比,而且嚇得不知如何是好了吧。”

根據澤爾的觀點,資金充沛的私人股本投資公司有能力從“荒謬”的杠桿收購中得利,並高價收購公開發行的房產公司。澤爾將這樁買賣稱為“教父的要約”,因為沒有一家公開發行公司能拒絕這一誘人的要求。果不其然,今年二月,澤爾以390億美元的高價將他的旗艦公司,辦公物業公司(Equity Office Products ,簡稱EOP),連同其資產組合中的540幢高級辦公樓出售給了黒石集團(Blackstone Group)。這是當時為止所完成的數額最大的一筆私營股權收購案例了。澤爾預測市場會馬上穩定下來,儘管與近幾年相比,市場會加倍進行風險規避,更少地利用杠桿。“今天,無人能再次複製黒石的交易了。”

賣掉了EOP之後,澤爾又將其註意力轉到了另一樁主要的收購上。八月,論壇公司(Tribune Co.)的股東們同意了澤爾開出的82億美元收購報價,該公司擁有《芝加哥論壇報》,《洛杉磯時報》和其它的媒體公司。這次的收購澤爾將芝加哥小熊棒球隊(Chicago Cubs)也收入囊中,但他說自己計劃將棒球隊轉售。論壇公司的交易正在規定的審查之中,有望於年底完成整個交易過程。

對這樁交易,澤爾並未直接提及,但他卻談到了自己作為逆勢投資人的名聲。他回憶起第一次親歷市場的轉機。上世紀七十年代,房地產市場被普遍看好且長勢逼人。澤爾無法預料在房地產市場未發育完整時,到底多少供應量才能滿足市場的缺口。因此他不再做新的交易,轉而建立了一家專註於蕭條地產市場的公司。“那時所有人都在批評說:‘山姆,你不知就裡。’這些話陪伴了我的整個職業生涯。甚至在2007年我購買報業時,也是人人都在議論,‘從前說你不明白,現在你可是真糊塗了。’”

澤爾是股本集團投資(Equity Group Investments)的主席,該集團是私人股本和公開發行公司的混合體,包括了住宅地產(Equity Residential),一家業內領先的住宅公司;生活時尚置業(Equity LifeStyle Properties),一家由300個度假和工廠預製住房協會的公司;和資產信托公司(Capital Trust),一家商業房地產金融公司。澤爾告訴沃頓的聽眾們,他還未從經濟學的第一堂課中“緩過神來”,那時他正在學供求關係。“我想告訴你們的是,無論身處何種行業—地產業、駁船業、軌道列車業—都是市場的供應和需求決定一切。”

上世紀六十年代中期,正在讀大學,之後成為密歇根大學法學院學生的澤爾已開始在安阿伯(Ann Arbor)購入房產。之後他與同父異母的兄弟羅伯特勞瑞(Robert Lurie)合伙,直至1990年勞瑞48歲時死於癌症,兩人共同建立起了一個地產王國。

在 1973年市場崩盤之後,澤爾用了之後的三年時間收購了近30億資產的地產資本,其中大部分只需一美元首付。通過承擔出租人在未來的管理中可能損失的費用,澤爾以此向他們換取股權。他有能力維繫這些物業,直至他們回到—甚至超過—先前購買時的價值。“事實證明,我們因次而大賺了一筆,”。從80年開始,房地產市場又一次顯現出強勁的承租漲勢,發展前景豁然明朗。澤爾說:“我的投資理念就是建立起資產組合,然後就會有人來購買,這些人指的就是日本人。”

當被利曼提問他為何沒有成為地產開發商時,這位滿臉胡茬,嗓音沉厚的地產大亨回答道,地產開發對於他來說風險太大。“從事開發,需要有種樓宇情結,”澤爾說道。“至少半數的回報率來自你親眼見著大樓逐漸高聳的心理成就感。我卻毫不受這痛苦的情結所困。”

考慮到市場可能無法消化巨額投資,澤爾和勞瑞在1980年花了大半年時間將他們的投資進行多元化,開始關註其他的一些行業。他們的策略與地產業曾使用的如出一轍,在人們忽視供求規則的地方尋找機會。“我們覺得如果自己是合格的地產人,那也算得上是出色的商人。”澤爾說道。

房產專業人士具備了嫻熟的交易技能,他補充道,但他們往往缺少運用策略的遠見卓識。“如果要請人代理進行交易協商,我一定會找一名房產商人而非公司經理人。 ”澤爾說道。但另一方面,地產人缺乏“在轉角尋找機遇”的能力,在他們看來,面前的永遠是筆直的道路。正因此,我們的行業缺乏周期性,直至今日都顯得反覆無常且大起大落。”

上世紀九十年代初,美國的大多數商業房產公司都被掌控於大約50至60家大型私人投資公司手中。然而,市場又一次出現了逆轉,這些公司紛紛陷入嚴重的信貸緊縮,大量資產被了結抵押,銀行發生擠兌,貸款市場幾近崩潰。澤爾解釋道,出路就是向公共市場要錢,通過一種之前鮮為人知的金融工具,即房地產投資信托基金(Real Estate Investment Trust)進行,簡稱REIT。據澤爾說,REIT從此成為商業房產市場的長期驅動力,直至過去一年左右,通過類似他的這次黑石公司的交易,私人股本的收購重將許多股份購回到私人手中。

黑石公司和沃納多房地產信托公司(Vornado Realty Trust)為爭奪EOP公司進行了三周的要價戰,澤爾描述了他在其間所使用的策略。沃納多作為美國第二大房地產投資信托基金,向澤爾的公司提供了一套現金與股票相混組合的收購報價。澤爾說道,收購的關鍵在於為EOP和其母公司準備一筆7億2千萬美金的“分手費”,另外他還補充,股票的交易可能需要花費數月完成,並且事後他也認識到,股票的交割可能因之後八月形成的市場震蕩而出現嚴重問題。

利曼註意到,現在澤爾的股份分散在房產和其他一些行業中。“其他”之一就是美國艾利斯特公司(Anixter International),該公司是乙太網路線市場的壟斷性企業。至於地產這方面,澤爾說他通過對國際股本集團(Equity Group International)的註資,關註著新興市場的發展。

1999年,澤爾決定,在美國使用的得心應手的REIT理念應該也能被覆制到世界的其他地方。現在他控制了墨西哥和巴西的主要房屋製造商並且正將其觸角伸及印度、中國和埃及。墨西哥公司設在瓜達拉哈拉城的辦事處豪邁斯(Homex)為了滿足墨西哥顧客的要求,每天24小時,每周7天辦公。“這些地方的美妙之處在於它們無窮無盡的市場需求,”澤爾說道。“如果回到教科書中的經濟學導論一章,我們會發現這些國家都有大量未能滿足的住房需求。它們的人口增加了但隨之而來的住房問題卻未能解決。”

澤爾也承認,在收購這個問題上他並不總是正確。他講述了1992年收購加州的卡特霍利霍爾連鎖店(Carter Hawley Hale stores)的經歷。他的公司對此進行了調查分析,認為如果該公司低價甩賣的話,這家擁有79所門店的連鎖店至少應值80%的收購價。收購後沒多久,留給澤爾的卻是市場的快速蕭條和南加州的一場大地震。95年時,他決定脫身出局,將連鎖店賣給了該店的競爭對手,聯邦百貨商店(Federated Department Stores)。賣了多少錢?儘管澤爾在這次交易中損失了些錢,但值得欣慰的是他的公司正確計算了轉手賣出的價格。聯邦公司支付了澤爾收購價的80%。“ 投資雖然失敗了,但過程卻是成功的。我們正確估計了風險並做好準備,事實上我們也確實承擔了風險。”

利曼註意到澤爾有個著名的別號叫“墳墓舞者”(the grave dancer)。澤爾說,這個詞來自於他曾撰寫的一篇文章的標題,該文闡述了市場經歷過熱投資帶來的必然經濟泡沫後,他怎樣從蕭條房產市場得利的策略。澤爾說這篇文章展示了他是怎樣“在他人錯誤的屍骸上起舞的”。

然而,澤爾也在該文的最後指出:“最靠近墳墓的舞者,也要時時註意自己不跌入死亡的深淵。”

- ↑ The 400 Richest Americans 49-75

- ↑ 2.0 2.1 The 400 Richest Americans #68 Samuel Zell

- ↑ Sam Zell, the 'grave dancer,' sees profit in newspapers

- ↑ Billionaire Investor Sam Zell at Glance

- ↑ Blackstone's Costly Buyout, Navistar's Listing

- ↑ The Equity Office Triple Flips

- ↑ Harold Meyerson, "The L.A. Times's Human Wrecking Ball", Washington Post, June 11, 2008

- ↑ Los Angeles Times staffers warned about behaving like Zell

- ↑ Let Sam be Sam, but you be nice

- ↑ Nathaniel Popper, "Billionaire Boychiks Battle for Media Empire: ‘Committed Zionist’ To Buy Papers With Troubled Ties to Community", The Forward, April 13, 2007

- ↑ In Political Contribution, Zell Leans Right and Wife Leans Left

- ↑ Feds: Governor tried to get Tribune writers fired

- ↑ Cubs Fans Consider a Wrigley by Any Other Name

- ↑ Cubs' new owner should think again about renaming Wrigley

- ↑ For Cubs fans, renaming Wrigley is dealbreaker

- ↑ Sam Zell leaves his mark on the Los Angeles Times

- 這個人怎麼搞垮論壇公司(圖)

- Sam Zell Biography

- The Zell Center for Risk Research at the Kellogg School of Management

- The Zell Lurie Institute: The University of Michigan

- The Samuel Zell and Robert Lurie Real Estate Center at Wharton

- The Zell entrepreneurship program at the Interdisciplinary Center, in Israel

- Detailed list of Zell's federal campaign contributions since 1979

- Zell's Year End Gift

- "What the Zell?" Chronicles one of the most-quotable men in journalism

- http://www.guardian.co.uk/business/2008/apr/30/useconomy.usa