已動用資本回報率

出自 MBA智库百科(https://wiki.mbalib.com/)

已動用資本回報率(Return on Capital Employed;ROCE ratio)

目錄 |

已動用資本回報率(Return on Capital Employed)用於衡量資本投資效益指標,是顯示公司資本投資效益及盈利能力的比率。換句話說, 已動用資本回報率是衡量公司運用資本產生回報情況的一個指標。[1]

一般來說,已動用資本回報率應該高於公司的借貸利率,否則的話,就會減少股東收益。

已動用資本回報率的計算公式[2]

已動用資本回報率的計算方法是,用息稅前利潤(EBIT)除以總資產和流動負債的差值。

|

ROCE= | EBIT | |

| Total Assets - Current Liabilities |

|

= | Operating Profit+interest | |

| Equity Shareholders' Funds+longterm borrowing |

Return on Capital Employed Ratio[3]

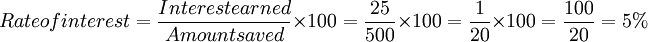

The Return on Capital Employed ratio (ROCE) tells us how much profit we earn from the investments the shareholders have made in their company. Think of it this way: if we had a savings account with a bank and we'd been paid, say, £25 interest at the end of a year; and we had saved £500, we could work out the rate of interest we had earned:

已動用資本回報率向我們展示從股東的投資中得到了多少收益。試著這樣想:如果我們有一個銀行存款賬戶,在每年年底能收到25英鎊的利息;我們往這個賬戶里存了500英鎊,然後就可以計算出我們賺得的利息率是多少。

So, we have earned 5% interest on our savings.

由上可得:我們在存款中賺到了5%的利息。

Imagine now that instead of talking about a savings account, we were talking about a company and the profit for the year and its capital employed had been £25 and £500 respectively then the ROCE for that company would be 5% too.

然後換一種方式想象存款賬戶,我們之前討論一個公司,它一年的收益以及動用的資本分別是25鎊和500鎊,所以這個公司的資本回報率也等於5%。

Did you notice that we use the Equity Shareholders' Funds instead of Capital Employed? In fact, they are different names for the same thing! We could call the ratio the Return on Shareholders' Funds (ROSF) just as easily if we wanted; but generations of accountants and students only know it as ROCE.

In accounting, there can be different definitions of what certain terms mean. The use of the term 'capital employed' can mean different things. It can, for example, include bank loans and overdrafts since these are funds employed within the firm. Because there are different interpretations of what ROCE can mean, it is suggested that you use a method which you feel comfortable with but be aware that others may interpret your definition in a different way. Below is a guide to some of the interpretations that we have found on this issue.

Source and/or Definition of Return Definition of Capital Employed Elliott & Elliott: ROCE = Net profit/capital employed Capital employed = total assets Investor Words: Capital employed = fixed assets + current assets - current liabilities investopedia.com: Return = Profit before tax + interest paid Capital employed = ordinary share capital + reserves + preference share capital + minority interest + provisions + total borrowings - intangible assets Holmes & Sugden: Return = trading profit plus income from investment and company share of the profit of associates TRADING capital employed = share capital + reserves + all borrowings including lease obligations, overdraft, minority interest, provisions, associates and investments OVERALL capital employed = share capital + reserves + all borrowings including lease obligations, overdraft, minority interest, provisions DTI Capital employed = total fixed assets + current assets - (current liabilities + long term liabilities + provisions) Johnson Matthey Annual Report & Accounts Capital employed = fixed assets + current assets - (creditors + provisions)

Let's calculate the ROCE for the Carphone Warehouse now; and here are the figures we need:

Carphone Warehouse 31 March 2001 25 March 2000 £'000 £'000 Profit for the financial period 38,159 16,327 Equity shareholders' funds 436,758 44,190

Off you go!

Did you get this?

What do we think of these results? Well, the question we have to ask is

"Could we have earned more money (profit) if we had invested in a different business or simply put our money in the bank?"

Well, interest rates at the bank were somewhere around 4 or 5% in 2001 so we did better than that; but there are many businesses that have a ROCE of higher than 8 or 9%. Still, in 2000 the Carphone Warehouse had an ROCE of almost 37%: that's very good by all standards.

So what went wrong between 2000 and 2001? What happened, it didn't necessarily go wrong, was that the capital employed increased from £44,190,000 to £436,758,000 (a 10 fold increase) BUT the profits increased from £16,327 to only £38,159... they only just about doubled.

It's no surprise then that the ROCE fell so sharply as capital employed increased 5 times faster than the profit did.

It will be interesting to see what 2002 brings for the Carphone Warehouse and their ROCE.

We will look at Vodafone's ROCE shortly, but for interest here are some other ROCE values to compare with the Carphone Warehouse:

Leisure & Hotels International Airline Manufacturer Retailer Discount Airline Refining Pizza Restaurants Accounting Software ROCE 5.56% 3.16% -12.12% -0.12% 33.63% 16.17% 16.14% 16.29%

Again, these other ROCE values demonstrate that not everyone can get the same results for the same ratio at the same time: it depends on the industry, the management, the economy and so on.

The ROCE results in this new table relate to the Carphone Warehouse's results for the year ended 25 March 2000 of 36.95%. This is a good result as it shows that the business is effectively earning around 37% on the (investment) funds that the shareholders have invested in it.

Contrast the other ROCE values with the Carphone Warehouse and we can see that only the discount airline has a ROCE value anywhere near it. The international airline's ROCE is extremely low at just over 3%. Wouldn't the shareholders be better off selling the business and putting the money in the bank as it would earn more than that?

We should also compare these ROCE values with the profitability values. Let's just compare net profitability with the ROCE.

Leisure & Hotels International Airline Manufacturer Retailer Discount Airline Refining Pizza Restaurants Accounting Software Net Profit 7.36% 4.05% -10.48% 1.63% 10.87% 12.63% 7.55% 27.15% ROCE 5.56% 3.16% -12.12% -0.12% 33.63% 16.17% 16.14% 16.29%

Putting the data from this table on a graph can help us to see if there is a relationship between them:

There does seem to be a relationship between the net profit margin and the ROCE: the higher the net profit margin, the higher the ROCE. After all, the curve on this graph is not a straight line and it might even be a true curve meaning that the relationship is more complex than we might think. Keep an eye on this relationship whenever you assess the profitability of a business.

- ↑ Ciaran Walsh - Key Management Ratios [中譯本《關鍵管理指標:掌握驅動和控制企業的管理工具》,北京經濟管理出版社,2005]

- ↑ Steven M. Bragg - Business Ratios and Formulas: A Comprehensive Guide

- ↑ Return on Capital Employed Ratio.www.bized.co.uk

評論(共9條)

分母應該也可以用Fixed assets + working capital來代替!!Therefore: ROCE=(EBIT-non operating income)/fixed assets + working capital

e...分母也要加括弧!

分母也就是total capital employed 嘛,therefore it is "fixed assets + current assets" or " current liability + long term liability + capital and reserves"

對,分子應該加long term borrowing ,是否應該減無形資產(intangible assets )呢? 分子也不對啊,Operating Profit 應該加上利息費用才對,是不是?

我是剛纔回覆評論的218.249.218.*。已對公式略微編輯一下,但對intangible assets 是否在分母吃不准,故沒動。

Capital employed 計算時,non-current assets中如果有deferred tax,是否要用除了deferred tax 的non-current asset?

分母應該也可以用Fixed assets + working capital來代替!!Therefore: ROCE=(EBIT-non operating income)/fixed assets + working capital